Homeowners Insurance in and around Dexter

Looking for homeowners insurance in Dexter?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Ann Arbor

- Chelsea

- Milan

- Saline

- Jackson

- Dexter

Home Is Where Your Heart Is

New home. New memories. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help protect your home in case of hailstorm or tornado, but it can also be beneficial in certain legal cases. If someone were to hold you financially accountable if they tripped in your home, the right homeowners insurance may be able to cover the cost.

Looking for homeowners insurance in Dexter?

The key to great homeowners insurance.

Protect Your Home Sweet Home

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Isaac Saucedo can be there whenever the unexpected happens, to get your homelife back to normal. State Farm is there for you.

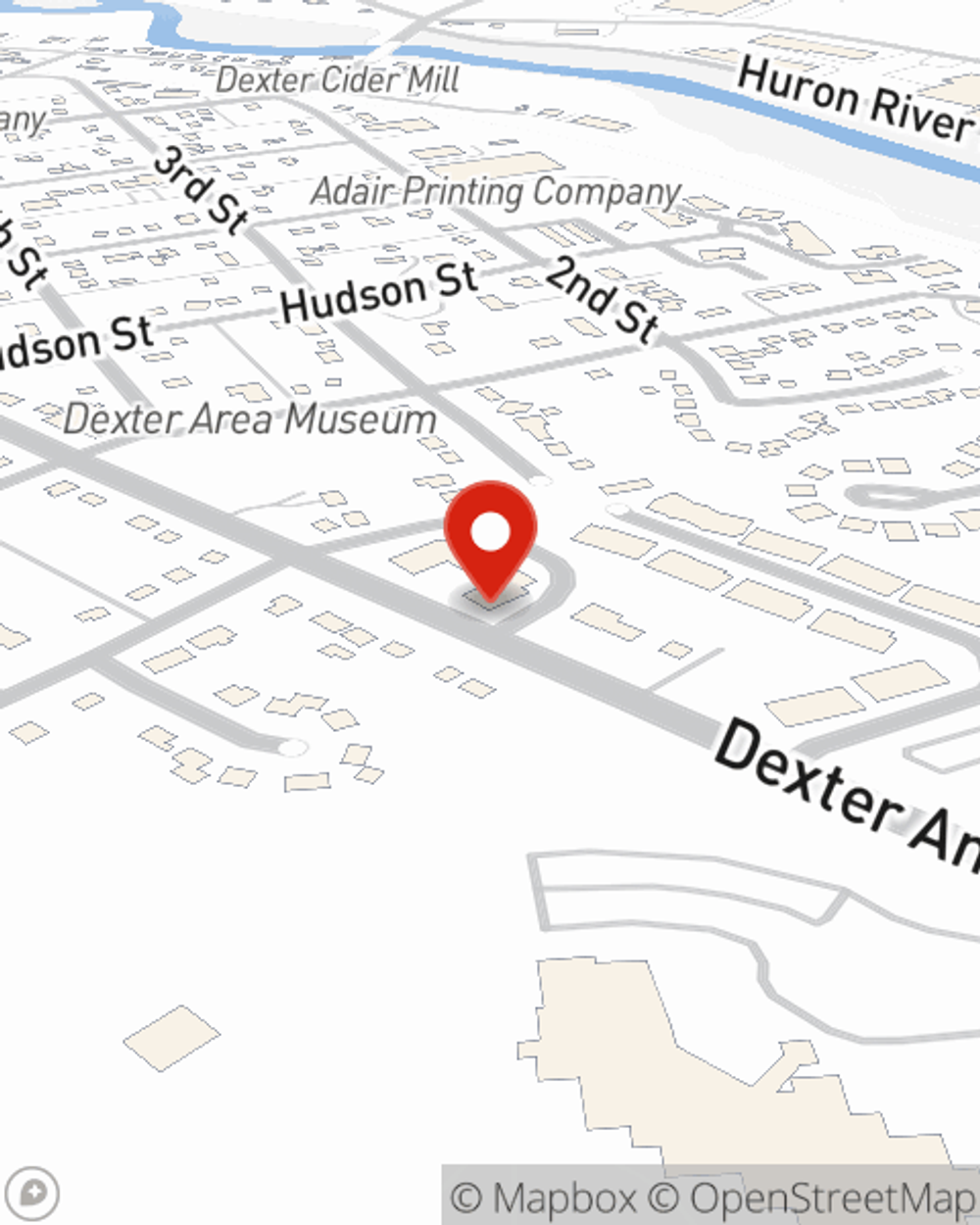

For excellent protection for your home and your personal belongings, check out the coverage options with State Farm. And if you're ready to get the ball rolling on a home insurance policy, stop by State Farm agent Isaac Saucedo's office today.

Have More Questions About Homeowners Insurance?

Call Isaac at (734) 408-4011 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What causes household mold?

What causes household mold?

Here are ways to cleanup and prevent household mold.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Isaac Saucedo

State Farm® Insurance AgentSimple Insights®

What causes household mold?

What causes household mold?

Here are ways to cleanup and prevent household mold.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.